|

Caldwell U.S. Dividend Adv Fd ETF Units (UDA)

|

As of March 31, 2024

|

|

(U.S. Equity)

|

|

Underlying Index

|

|

Inception Return

(3/18/2020)

|

15.57 %

|

|

Day High/Low

|

$15.70 / $15.70

|

|

YTD Return

|

19.32 %

|

|

52Week High/Low

|

$16.53 / $12.97

|

|

|

|

|

|

NAVPS

(4/18/2024)

|

$15.58

|

|

Change

|

$-0.20 / -1.27 %

$-0.20 / -1.27 %

|

Open / Close

(4/18/2024)

|

$15.70

/

$15.70

|

|

|

|

Management Fee

|

0.75 %

|

|

Traded Volume

|

812

|

|

Assets ($mil)

|

-

|

|

Rank (1Yr)

|

1041/1288

|

|

Std Dev (3Yr)

|

-

|

|

Beta (3Yr)

|

-

|

|

Volatility Ranking (3Yr)

|

6/10

|

|

RRSP Eligibility

|

Yes

|

|

Open to Invest

|

Open

|

|

Annual Dividend

|

$0.46

|

|

Annual Yield

|

2.90 %

|

|

|

Objective

The fundamental investment objective of the Fund is to provide unitholders with: (i) monthly distributions; and (ii) the potential for capital appreciation and enhanced long-term risk adjusted returns. The Fund invests primarily in dividend paying equity securities of U.S. domiciled issuers or issuers that derive a significant portion of their revenue or earnings from the U.S.

|

Fund Manager

Caldwell Investment Management Ltd.

Portfolio Manager

Caldwell Investment Management Ltd.

Sub-Advisor

Data not available

|

|

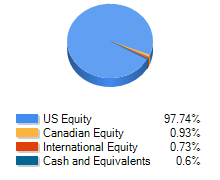

Asset Allocation

(As of March 31, 2024)

|

Sector Allocation

(As of March 31, 2024)

|

Geographic Allocation

(As of March 31, 2024)

|

Top 10 Holdings

| Name | Asset | Sector | Geographic | Percent |

| Mastercard Inc Cl A | US Equity | Financial Services | United States | 6.81% |

| Comfort Systems USA Inc | US Equity | Industrial Goods | United States | 6.50% |

| Quanta Services Inc | US Equity | Real Estate | United States | 6.30% |

| Broadcom Inc | US Equity | Technology | United States | 6.22% |

| Booz Allen Hamilton Holding Corp Cl A | US Equity | Technology | United States | 6.07% |

| Costco Wholesale Corp | US Equity | Consumer Services | United States | 5.99% |

| Microsoft Corp | US Equity | Technology | United States | 5.66% |

| Parker-Hannifin Corp | US Equity | Industrial Goods | United States | 5.52% |

| Eli Lilly and Co | US Equity | Healthcare | United States | 5.46% |

| Entegris Inc | US Equity | Technology | United States | 5.09% |

Performance Data

(As of March 31, 2024)

|

|

Return (%)

|

Annualized Return (%)

|

|

Return

|

1

Mth

|

3

Mth

|

6

Mth

|

YTD

|

1

Yr

|

3

Yr

|

5

Yr

|

10

Yr

|

|

Fund

|

2.97

|

19.32

|

21.75

|

19.32

|

20.86

|

10.48

|

-

|

-

|

|

Benchmark

|

3.07

|

13.26

|

23.76

|

13.26

|

30.04

|

14.30

|

15.37

|

15.28

|

|

Quartile Ranking

|

2

|

1

|

3

|

1

|

4

|

3

|

-

|

-

|

|

Calendar Return (%)

|

2023

|

2022

|

2021

|

2020

|

2019

|

2018

|

2017

|

2016

|

2015

|

2014

|

|

Fund

|

0.87

|

-4.58

|

22.19

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Benchmark

|

23.32

|

-12.52

|

28.16

|

16.07

|

25.18

|

3.98

|

13.80

|

8.65

|

20.77

|

24.19

|

|

Quartile Ranking

|

4

|

1

|

3

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|