|

Dynamic Active Global Finan Serv ETF (DXF)

|

As of March 31, 2024

|

|

(Financial Services Equity)

|

|

FundGrade A+

® Rating recipient

For more information about FundGrade

click here

2020

Underlying Index

|

|

Inception Return

(9/22/2017)

|

11.97 %

|

|

Day High/Low

|

- / -

|

|

YTD Return

|

10.60 %

|

|

52Week High/Low

|

$37.76 / $28.51

|

|

|

|

|

|

NAVPS

(4/22/2024)

|

$37.07

|

|

Change

|

$0.23 / 0.63 %

$0.23 / 0.63 %

|

Open / Close

(4/22/2024)

|

-

/

$36.62

|

|

|

|

Management Fee

|

0.75 %

|

|

Traded Volume

|

0

|

|

Assets ($mil)

|

-

|

|

Rank (1Yr)

|

13/71

|

|

Std Dev (3Yr)

|

20.34 %

|

|

Beta (3Yr)

|

1.03

|

|

Volatility Ranking (3Yr)

|

10/10

|

|

RRSP Eligibility

|

Yes

|

|

Open to Invest

|

Open

|

|

Annual Dividend

|

$0.73

|

|

Annual Yield

|

2.00 %

|

|

|

Objective

DXF seeks to provide long-term capital growth by investing primarily in equity securities of companies globally, with a focus in the U.S., that are involved in the financial services and/or financial technology sectors. Exposure to these types of equity securities will be obtained by investing primarily in Dynamic Active Global Financial Services Fund (the “Dynamic AGFS Fund”), and/or by investing directly in them, in securities of one or more Other Funds, and/or through the use of derivatives.

|

Fund Manager

1832 Asset Management L.P.

Portfolio Manager

Yassen Dimitrov, 1832 Asset Management L.P.

Sub-Advisor

Data not available

|

|

Asset Allocation

(As of January 31, 2024)

|

Sector Allocation

(As of January 31, 2024)

|

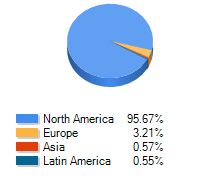

Geographic Allocation

(As of January 31, 2024)

|

Top 10 Holdings

| Name | Asset | Sector | Geographic | Percent |

| Euronext NV | International Equity | Financial Services | European Union | 5.97% |

| Partners Group Holding AG | International Equity | Financial Services | Other European | 5.44% |

| Intermediate Capital Group PLC | International Equity | Financial Services | European Union | 4.88% |

| Apollo Global Management Inc | US Equity | Financial Services | United States | 4.76% |

| Visa Inc Cl A | US Equity | Financial Services | United States | 4.74% |

| Ares Management Corp Cl A | US Equity | Financial Services | United States | 4.44% |

| Deutsche Boerse AG Cl N | International Equity | Financial Services | European Union | 4.25% |

| CME Group Inc Cl A | US Equity | Financial Services | United States | 4.03% |

| Brookfield Corp Cl A | Canadian Equity | Financial Services | Canada | 3.79% |

| Truist Financial Corp | US Equity | Financial Services | United States | 3.70% |

Performance Data

(As of March 31, 2024)

|

|

Return (%)

|

Annualized Return (%)

|

|

Return

|

1

Mth

|

3

Mth

|

6

Mth

|

YTD

|

1

Yr

|

3

Yr

|

5

Yr

|

10

Yr

|

|

Fund

|

3.07

|

10.60

|

26.12

|

10.60

|

29.36

|

7.00

|

11.84

|

-

|

|

Benchmark

|

3.76

|

9.87

|

21.36

|

9.87

|

25.68

|

9.79

|

8.54

|

8.93

|

|

Quartile Ranking

|

4

|

2

|

1

|

2

|

1

|

3

|

1

|

-

|

|

Calendar Return (%)

|

2023

|

2022

|

2021

|

2020

|

2019

|

2018

|

2017

|

2016

|

2015

|

2014

|

|

Fund

|

17.39

|

-18.90

|

22.40

|

9.70

|

38.76

|

-1.39

|

-

|

-

|

-

|

-

|

|

Benchmark

|

13.41

|

-5.68

|

22.05

|

-5.24

|

19.43

|

-4.99

|

15.24

|

6.34

|

14.20

|

14.35

|

|

Quartile Ranking

|

1

|

4

|

4

|

1

|

1

|

1

|

-

|

-

|

-

|

-

|