|

CI MStar Intl Value Index ETF (VXM.B)

|

As of March 31, 2024

|

|

(International Equity)

|

|

FundGrade A+

® Rating recipient

For more information about FundGrade

click here

Underlying Index

|

Morningstar® Developed Markets ex-North America Target Value Index

|

Inception Return

(11/13/2014)

|

6.70 %

|

|

Day High/Low

|

- / -

|

|

YTD Return

|

8.87 %

|

|

52Week High/Low

|

$30.30 / $23.24

|

|

|

|

|

|

NAVPS

(4/24/2024)

|

$29.95

|

|

Change

|

$0.14 / 0.46 %

$0.14 / 0.46 %

|

Open / Close

(4/24/2024)

|

-

/

$29.47

|

|

|

|

Management Fee

|

0.60 %

|

|

Traded Volume

|

67

|

|

Assets ($mil)

|

$268.82

|

|

Rank (1Yr)

|

59/742

|

|

Std Dev (3Yr)

|

16.23 %

|

|

Beta (3Yr)

|

1.10

|

|

Volatility Ranking (3Yr)

|

6/10

|

|

RRSP Eligibility

|

Yes

|

|

Open to Invest

|

Open

|

|

Annual Dividend

|

$1.03

|

|

Annual Yield

|

3.48 %

|

|

|

Objective

The CI Morningstar International Value Index ETF has been designed to replicate the performance of the Morningstar® Developed Markets ex-North America Target Value Index, net of expenses.

|

Fund Manager

CI Investments Inc

Portfolio Manager

CI Investments Inc

Sub-Advisor

Data not available

|

|

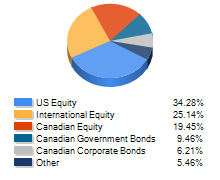

Asset Allocation

(As of March 31, 2024)

|

Sector Allocation

(As of March 31, 2024)

|

Geographic Allocation

(As of March 31, 2024)

|

Top 10 Holdings

| Name | Asset | Sector | Geographic | Percent |

| Yue Yuen Industrial (Holdings) Ltd | International Equity | Consumer Goods | Asia/Pacific Rim | 0.66% |

| Virgin Money UK PLC | International Equity | Financial Services | European Union | 0.64% |

| Rubis SCA | International Equity | Energy | European Union | 0.63% |

| First Pacific Co Ltd | International Equity | Consumer Goods | Asia/Pacific Rim | 0.58% |

| Renault SA | International Equity | Consumer Goods | European Union | 0.58% |

| TP ICAP Group PLC | International Equity | Financial Services | European Union | 0.57% |

| Banco Comercial Portugues SA | International Equity | Financial Services | European Union | 0.57% |

| Tokyo Electric Power Co Holdings Inc | International Equity | Utilities | Japan | 0.56% |

| Hokkaido Electric Power Co Inc | International Equity | Utilities | Japan | 0.56% |

| HeidelbergCement AG | International Equity | Industrial Goods | European Union | 0.56% |

Performance Data

(As of March 31, 2024)

|

|

Return (%)

|

Annualized Return (%)

|

|

Return

|

1

Mth

|

3

Mth

|

6

Mth

|

YTD

|

1

Yr

|

3

Yr

|

5

Yr

|

10

Yr

|

|

Fund

|

3.91

|

8.87

|

14.10

|

8.87

|

19.49

|

8.70

|

5.46

|

-

|

|

Benchmark

|

3.12

|

7.59

|

16.68

|

7.59

|

15.23

|

5.89

|

7.22

|

6.93

|

|

Quartile Ranking

|

1

|

2

|

3

|

2

|

1

|

1

|

3

|

-

|

|

Calendar Return (%)

|

2023

|

2022

|

2021

|

2020

|

2019

|

2018

|

2017

|

2016

|

2015

|

2014

|

|

Fund

|

18.47

|

-1.58

|

9.88

|

-11.22

|

10.02

|

-11.01

|

23.25

|

4.06

|

18.32

|

-

|

|

Benchmark

|

15.74

|

-10.67

|

8.97

|

8.01

|

16.27

|

-6.81

|

18.37

|

-1.70

|

19.41

|

4.12

|

|

Quartile Ranking

|

1

|

1

|

2

|

4

|

4

|

3

|

1

|

1

|

2

|

-

|