|

Horizons Gold Producer Equity Cov Call ETF (GLCC)

|

As of March 31, 2024

|

|

(Precious Metals Equity)

|

|

Underlying Index

|

|

Inception Return

(4/11/2011)

|

-1.65 %

|

|

Day High/Low

|

$25.40 / $25.16

|

|

YTD Return

|

2.04 %

|

|

52Week High/Low

|

$29.49 / $19.22

|

|

|

|

|

|

NAVPS

(4/18/2024)

|

$25.25

|

|

Change

|

$0.09 / 0.36 %

$0.09 / 0.36 %

|

Open / Close

(4/18/2024)

|

$25.40

/

$25.25

|

|

|

|

Management Fee

|

0.65 %

|

|

Traded Volume

|

5,304

|

|

Assets ($mil)

|

-

|

|

Rank (1Yr)

|

27/77

|

|

Std Dev (3Yr)

|

32.06 %

|

|

Beta (3Yr)

|

0.91

|

|

Volatility Ranking (3Yr)

|

10/10

|

|

RRSP Eligibility

|

Yes

|

|

Open to Invest

|

Open

|

|

Annual Dividend

|

$2.64

|

|

Annual Yield

|

10.46 %

|

|

|

Objective

The investment objective of HEP is to provide unitholders with: (a) exposure to the performance of an equal weighted portfolio of North American based gold mining and exploration companies; and (b) monthly distributions of dividend and call option income. Any foreign currency gains or losses as a result of HEP's investment in non-Canadian issuers will be hedged back to the Canadian dollar to the best of its ability.

|

Fund Manager

Horizons ETFs Management (Canada) Inc.

Portfolio Manager

Horizons ETFs Management (Canada) Inc.

Sub-Advisor

Data not available

|

|

Asset Allocation

(As of March 31, 2024)

|

Sector Allocation

(As of March 31, 2024)

|

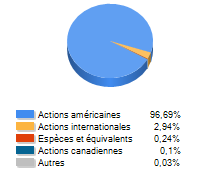

Geographic Allocation

(As of March 31, 2024)

|

Top 10 Holdings

| Name | Asset | Sector | Geographic | Percent |

| Agnico Eagle Mines Ltd | Canadian Equity | Basic Materials | Canada | 10.25% |

| Barrick Gold Corp | Canadian Equity | Basic Materials | Canada | 10.02% |

| Kinross Gold Corp | Canadian Equity | Basic Materials | Canada | 9.96% |

| Newmont Corp | US Equity | Basic Materials | United States | 9.74% |

| Gold Fields Ltd - ADR | International Equity | Basic Materials | Africa and Middle East | 9.62% |

| AngloGold Ashanti Ltd | International Equity | Basic Materials | Africa and Middle East | 9.29% |

| Alamos Gold Inc Cl A | Canadian Equity | Basic Materials | Canada | 7.74% |

| Pan American Silver Corp | Canadian Equity | Basic Materials | Canada | 7.27% |

| Harmony Gold Mining Co Ltd - ADR | International Equity | Basic Materials | Africa and Middle East | 6.70% |

| Endeavour Mining PLC | International Equity | Basic Materials | European Union | 6.59% |

Performance Data

(As of March 31, 2024)

|

|

Return (%)

|

Annualized Return (%)

|

|

Return

|

1

Mth

|

3

Mth

|

6

Mth

|

YTD

|

1

Yr

|

3

Yr

|

5

Yr

|

10

Yr

|

|

Fund

|

19.58

|

2.04

|

18.90

|

2.04

|

-0.33

|

2.67

|

7.40

|

5.65

|

|

Benchmark

|

18.87

|

2.02

|

15.68

|

2.02

|

-5.10

|

0.90

|

9.72

|

5.03

|

|

Quartile Ranking

|

2

|

3

|

2

|

3

|

2

|

3

|

4

|

3

|

|

Calendar Return (%)

|

2023

|

2022

|

2021

|

2020

|

2019

|

2018

|

2017

|

2016

|

2015

|

2014

|

|

Fund

|

6.35

|

-1.95

|

-9.32

|

15.05

|

38.40

|

-0.14

|

7.37

|

41.97

|

-11.00

|

-9.90

|

|

Benchmark

|

1.85

|

-2.48

|

-7.16

|

25.38

|

42.02

|

-3.46

|

0.96

|

55.11

|

-17.99

|

-14.81

|

|

Quartile Ranking

|

1

|

1

|

3

|

4

|

3

|

1

|

1

|

4

|

4

|

4

|